nc state sales tax on food

Local 4620 Mill. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent.

North Carolina Sales Tax Rates By City County 2022

You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin.

. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Prepared Food Fiscal Year 08-09 Sales and use tax rate 675 State 444 Local 231 Revenue 14 Bill. State 8866 Mill.

425 sales tax rate temporary 2007. Find your North Carolina combined state and local tax rate. 92 out of the 100 counties in North Carolina collect a local surtax of 2.

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. The exemption only applies to sales tax on food purchases. North Carolina has a 475 statewide sales tax rate but also has 460 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax.

Kit Kats contain flour. Both the charge for the dining plan and the tax surcharge will be listed separately on students bursar bills. Sales and Use Tax Sales and Use Tax.

45 sales tax rate temporary 2006. Select the North Carolina city from the. 3 sales tax rate 1991.

As of 2014 there were 1012 taxing districts in North Carolina including counties cities and. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales.

Market will not inquire about a vendors sales tax collections or their business with the NC. This page describes the taxability of food and meals in North Carolina including catering and grocery food. Sales and Use Tax Sales and Use Tax.

Streamlined Sales and Use Tax. 425 sales tax rate permanent 2008. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale.

North Carolina sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. North Carolina State Tax Quick Facts. 31 rows The state sales tax rate in North Carolina is 4750.

To learn more see a full list of taxable and tax-exempt items in North Carolina. Of Revenue makes it possible to obtain a Certificate of. Tax on Restaurant Foods in North Carolina State Sales Tax.

Candy is subject to the combined state and local sales tax rate. With local taxes the total sales tax rate is between 6750 and 7500. For example Wake County imposes a 1 tax prepared food and beverages.

North Carolina sales tax rates vary depending on which county and city youre in which can. Four bills have already been introduced two in the House and two in the Senate that would eliminate the 65 state sales tax on food. The transit and other local rates do not apply to qualifying food.

State General Sales Tax Rate Changes 1933. 55 sales tax rate temporary 2009. North Carolina has recent rate changes Fri Jan 01 2021.

Tax Advisors of Cary partner Robert Mayhew said his team is preparing to more than than 1000 individual tax returns. Student dining plans are now being taxed at the combined state and Durham county rate of 75. 575 sales tax rate Medicaid Swap.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Ergo they are food. Sales Tax at Farmers Markets in North Carolina Legislation adopted by the NC General Assembly in 2013 strengthens and clarifies existing state.

This tax is administered by the county and is not subject to the exemption. 45 sales tax rate Medicaid swap 2009. North carolina 475 4 north dakota 5 ohio 575 oklahoma 45 oregon none -- -- --pennsylvania 6 rhode island 7 south carolina 6 south dakota 45 tennessee 7 4 4 texas 625 utah 61 5 30 5 vermont 6 virginia 53 2 25 2 washington 65 west virginia 6 wisconsin 5 wyoming 4 dist.

The funds for the meal plan and the NC Sales Tax Surcharge are added to the students DukeCard food point account. When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax.

Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale. The North Carolina use tax rate is 475 the same as the regular North Carolina sales tax. Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants.

35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Semantics aside in North Carolina.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The base state sales tax rate in North Carolina is 475. 105-164328 and reads as follows.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Including local taxes the North Carolina use tax can be as high as 2750. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax.

Food and food ingredients excluding alcoholic beverages and tobacco are subject to a lower rate of 2. 4 sales tax rate 2001. NC State is not exempt from the prepared food and beverage taxes administered by local counties and municipalities.

The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General AssemblyThe provision is found in GS. Food and food ingredients excluding alcoholic beverages and tobacco are subject to a lower rate of 2.

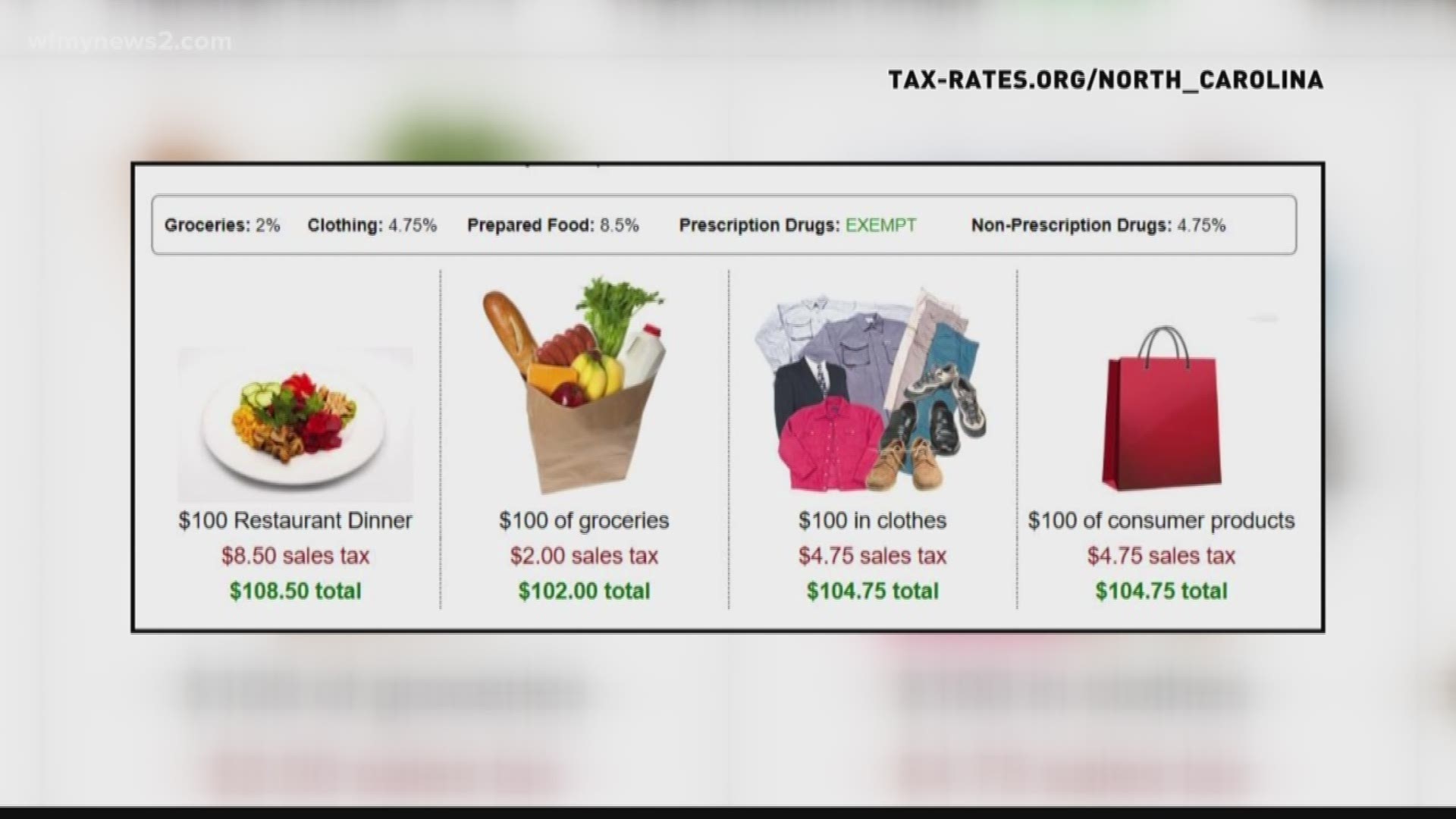

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Free Online 2018 Us Sales Tax Calculator For 89448 Zephyr Cove Fast And Easy 2018 Sales Tax Tool For Businesses And People From 89448 Z Sales Tax Topeka Tax

Is Food Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

Pin On Top 20 Weekly Deals From Your Favorite Stores

Gameday Ncsu Women S Boot Ncs L052 1 Womens Boots Boots Gameday Boots

Love It Let S Go Wolfpack Ncsu Nc State Wolf Pack Nc State Wolfpack

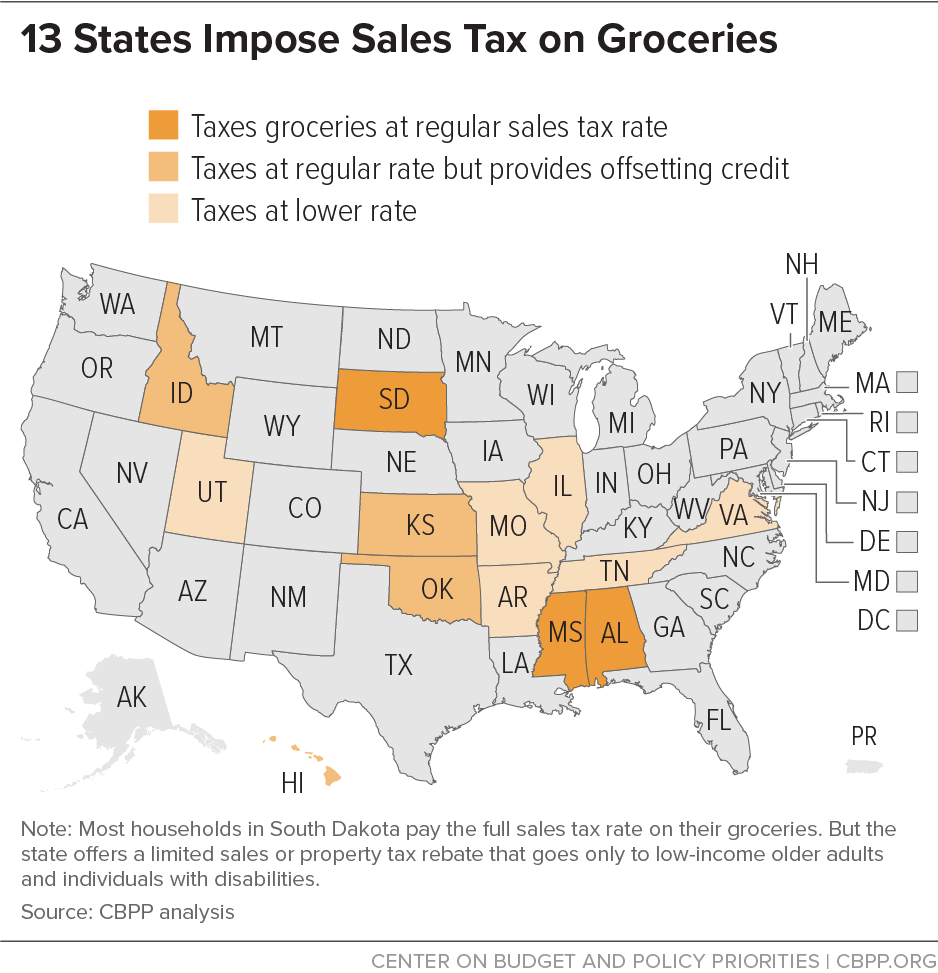

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

State By State Guide To Taxes On Retirees Kiplinger Retirement Advice Retirement Tax

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

Is Food Taxable In North Carolina Taxjar

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

Florida Taxes Florida County Map Map Of Florida Map Of Florida Beaches

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is Food Taxable In North Carolina Taxjar

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association